The corporate tax rate in Malaysia is collected from companies. Personal income tax in Malaysia is charged at a progressive rate between 0 28.

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

The carryback of losses is not permitted.

. Malaysia Corporate Tax Rate was 24 in 2022. On the First 2500. Following the Budget 2020 announcement in October 2019 the reduced rate.

Corporate companies are taxed at the rate of 24. A resident company incorporated in Malaysia with an ordinary paid-up share capital of RM25 million and belowor 2. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

These will be relevant for filing Personal income tax 2018 in Malaysia. Now that youre up to speed on whether youre eligible for taxes and how the tax rates work lets get down to the business of. Budget 2019 Finance Bill 2018 Income Tax Amendment Bill 2018 and Labuan Business.

Similarly those with a chargeable. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. It is proposed that the income tax rate on first RM500000 of.

Interest paid by approved financial institutions. On the First 5000. The benchmark used pertains to the.

For Year of Assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. Social Security Rate. This rate is relatively lower than what we have seen in the previous year.

On the next chargeable earnings. Rate The standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie. Here are the tax rates for personal income tax in Malaysia for YA 2018.

Any unutilised losses can be carried forward for a maximum period of 7 consecutive YAs 10 consecutive YAs wef YA 2019 to be utilised against income from any business sourceUnutilised losses accumulated as at YA 2018 can be utilised for 7 consecutive YAs 10. Companies incorporated in Malaysia with paid-up capital of MYR 25 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on. Sales Tax Rate 2021.

Tax Rate of Company. A Limited Liability Partnership LLP resident in Malaysia with. Technical fees payment for services or payment for use of moveable property.

Business losses can be set off against income from all sources in the current year. In general capital gains are not taxable. The current CIT rates are provided in the following table.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018. Corporate Tax Rates in Malaysia.

The corporate tax rate has decreased from 40 in the late 1980s to the current rate of 24. A company will be a Malaysian tax resident if at any time during the basis year the management and control of the companys business or any one of its businesses are exercised in Malaysia. 20182019 Malaysian Tax Booklet 22 Rates of tax 1.

Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower. Income tax rate Malaysia 2018 vs 2017. For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24.

Not only has the corporate tax rate been decreased over the years the government has also given SMEs a special rate of 17 on the first RM500000 chargeable income for YA 2019. Paid-up Capital of over 25 Million Malaysian Rupees. Other income is taxed at a rate of 26 for 2014 and 25 for 2015.

With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million. It is Necessary to Be Aware of the Malaysia Corporate Tax Rate 2019 Because It is a Factor in the Success of Your Business. Small and medium enterprises SMEs pay slightly different company tax as compared.

These new rates will apply for those who have accumulated their income from January 2018 to December 2018 and are filing their taxes from March April 2019. These companies are taxed at a rate of 24 Annually. On the initial RM 600000 chargeable earnings.

On the First 5000. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively. 11 Business environment 12 Currency 13 Banking and financing 14 Foreign investment 15 Tax incentives 16 Exchange controls 20 Setting up a business 21 Principal forms of business entity 22 Regulation of business 23 Accounting filing and auditing requirements 30 Business taxation 31 Overview 32 Residence 33 Taxable income and rates.

Tax rates of corporate tax Year of Assessment 2020 Paid-up Capital of 25 Million Malaysian Rupees or less Rate Applicable. Payments to foreign affiliates. Special classes of income.

Personal Income Tax Rate 2021. Chargeable Income RM Calculations RM Rate Tax M 0 5000. What is the Corporate Tax Rate in Malaysia.

Contract payment for services done in Malaysia. Income tax is imposed on a territorial basis except for income of a resident company carrying on a business of banking insurance or. Malaysia Personal Income Tax Rate.

Calculations RM Rate TaxRM A. Basis of Taxation. 24 Tax on Royalties.

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25 600000 133650 26 1000000 237650 28 A qualified person defined who is a knowledge worker residing in. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Tax rates for non-resident companybranch If the recipient is resident in a country which has entered a double tax agreement with Malaysia the tax rates for specific sources of income may be reduced.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the. Non-residents are subject to withholding taxes on certain types of income. The amount from this is based on the total income that companies obtain while having a business activity every year.

Capital Gains Tax in Malaysia. On the First 5000 Next 15000. The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia.

A Malaysian company can claim a deduction for royalties management service fees and interest charges paid to foreign affiliates provided that these are made at arms length and the relevant WHTs where applicable have been deducted and remitted to the Malaysian tax authorities. For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups.

Income Tax Malaysia 2018 Mypf My

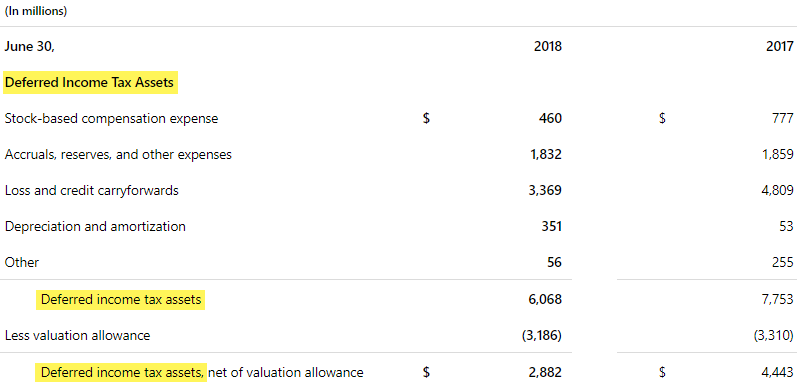

Deferred Tax Asset Journal Entry How To Recognize

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Do You Need To File A Tax Return In 2018

Real Property Gains Tax Part 1 Acca Global

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006 2020 Historical

How To Report Foreign Rental Income On Overseas Property

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Income Tax Malaysia 2018 Mypf My

Malaysia Payroll And Tax Activpayroll

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Doing Business In The United States Federal Tax Issues Pwc

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Income Tax Malaysia 2018 Mypf My